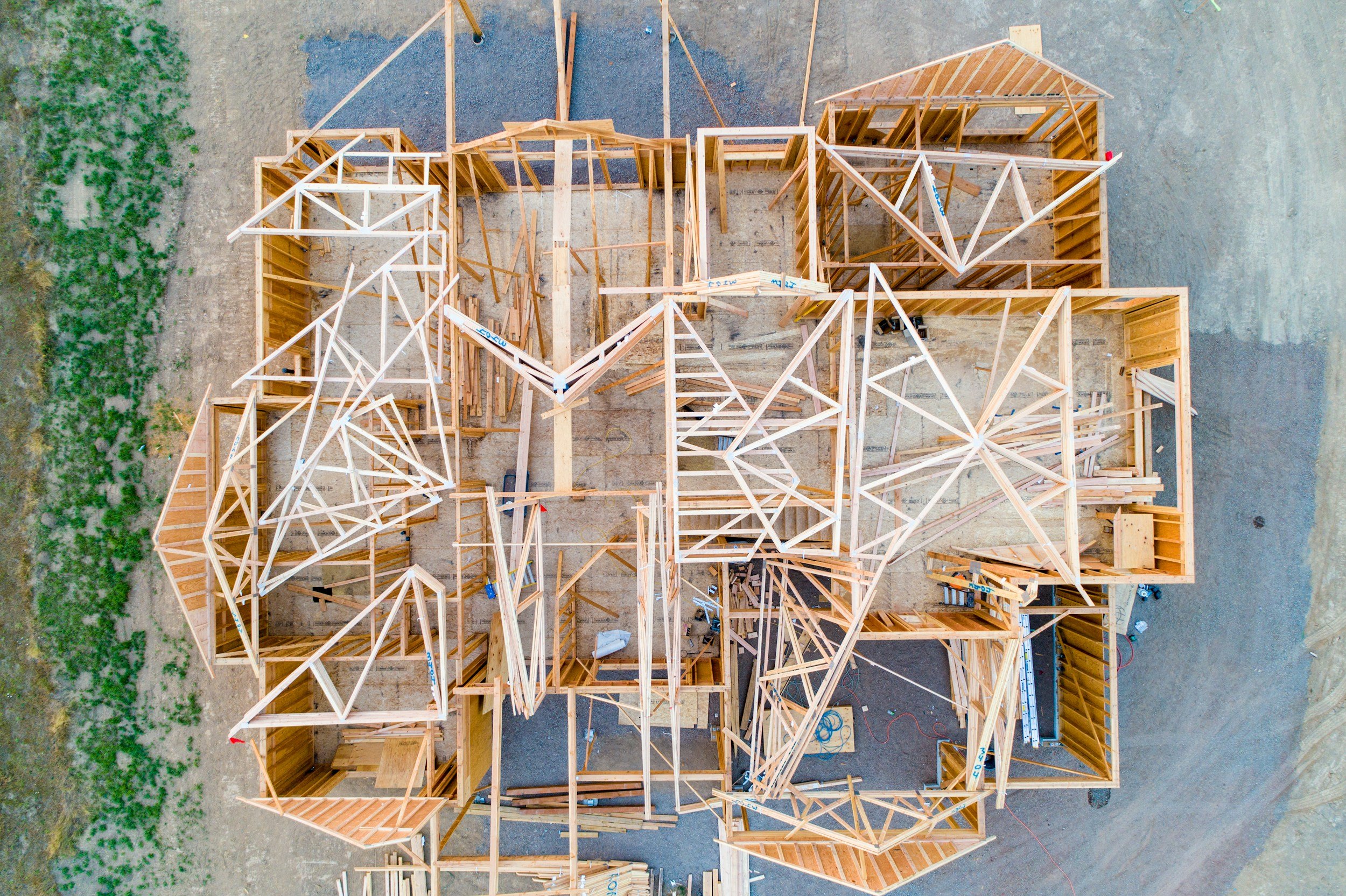

Construction is a challenging industry. With shifting project requirements, changes to subcontractor schedules, materials sourcing and change orders, it’s no wonder that construction faces some unique bookkeeping requirements. At Co|Constructors we’re with you. We’ll work together to customize your backend accounting and bookkeeping so you can get back to what matters most—serving your clients.

Co|Operators

Co|llaborators

Co|Pilots

Co|Constructors

ESSENTIAL

We categorize your transactions, attach revenue and expenses to jobs, produce monthly reports and keep your books running smoothly.

-

We link expense and income transactions to your accounts, or categories in Quickbooks Online

-

We input bills from your vendors and subcontractors into Quickbooks, complete with terms, dates, details and a digitized copy.

-

We match transactions from your checking, credit and other balance sheets accounts to your records in Quickbooks Online

-

Balance Sheet, Income Statement and Cash Flow sent to your inbox each month.

-

Protect your previous quarter records by “closing” them, helping to ensure that your books are ready for tax season.

-

All receipts and reports are stored in Quickbooks Online and backed up on Google Drive where needed.

-

A phone call or Zoom meeting to go over monthly events and to provide updates.

-

Phone call or Zoom meeting to review quarter-end activities and closing.

-

We will develop package for your accountant/tax preparer.

-

We assign transactions to jobs as tracked in the ‘Projects’ section of QBO. This makes profitability reporting more dynamic and insightful.

PLUS

We’ll track AP/AR, depreciate fixed assets, collect W9s, produce 1099s, ensure correct categorization of customer deposits and more.

-

We link expense and income transactions to your accounts, or categories in Quickbooks Online

-

We input bills from your vendors and subcontractors into Quickbooks, complete with terms, dates, details and a digitized copy.

-

We match transactions from your checking, credit and other balance sheets accounts to your records in Quickbooks Online

-

Balance Sheet, Income Statement and Cash Flow sent to your inbox each month.

-

Protect your previous quarter records by “closing” them, helping to ensure that your books are ready for tax season.

-

All receipts and reports are stored in Quickbooks Online and backed up on Google Drive where needed.

-

A phone call or Zoom meeting to go over monthly events and to provide updates.

-

Phone call or Zoom meeting to review quarter-end activities and closing.

-

We will develop package for your accountant/tax preparer.

-

We assign transactions to jobs as tracked in the ‘Projects’ section of QBO. This makes profitability reporting more dynamic and insightful.

-

Phone call or Zoom meeting to review activities for the week.

-

We will help you track and depreciate your valuable, durable, equipment.

-

We’ll track and reconcile your customer deposits, helping to ensure correct categorization as a deferred-revenue transaction.

-

We’ll run monthly reports showing who the business owes, as well as who owes the business.

-

We’ll collect and store W9s from contractors, ensuring that your end-of-year 1099 processing goes smoothly.

-

At year end, we’ll compile your list of 1099-eligible contractors. We’ll confirm the accuracy of your records, then print and mail them to your contractors. Additionally, we’ll file them with the IRS and state agencies, when necessary.

-

Used in place of, or in addition to Class and Location Tracking; Tags provide unique insights into your transactions--either for short-term tracking or for situations where you want to track a range of internal data points.

ADVANCED

At this tier we’ll also take on the time intensive work of invoicing your clients, paying company bills, plus additional high-value tasks.

-

We link expense and income transactions to your accounts, or categories in Quickbooks Online

-

We input bills from your vendors and subcontractors into Quickbooks, complete with terms, dates, details and a digitized copy.

-

We match transactions from your checking, credit and other balance sheets accounts to your records in Quickbooks Online

-

Balance Sheet, Income Statement and Cash Flow sent to your inbox each month.

-

Protect your previous quarter records by “closing” them, helping to ensure that your books are ready for tax season.

-

All receipts and reports are stored in Quickbooks Online and backed up on Google Drive where needed.

-

A phone call or Zoom meeting to go over monthly events and to provide updates.

-

Phone call or Zoom meeting to review quarter-end activities and closing.

-

We will develop package for your accountant/tax preparer.

-

We assign transactions to jobs as tracked in the ‘Projects’ section of QBO. This makes profitability reporting more dynamic and insightful.

-

Phone call or Zoom meeting to review activities for the week.

-

We will help you track and depreciate your valuable, durable, equipment.

-

We’ll track and reconcile your customer deposits, helping to ensure correct categorization as a deferred-revenue transaction.

-

We’ll run monthly reports showing who the business owes, as well as who owes the business.

-

We’ll collect and store W9s from contractors, ensuring that your end-of-year 1099 processing goes smoothly.

-

At year end, we’ll compile your list of 1099-eligible contractors. We’ll confirm the accuracy of your records, then print and mail them to your contractors. Additionally, we’ll file them with the IRS and state agencies, when necessary.

-

Used in place of, or in addition to Class and Location Tracking; Tags provide unique insights into your transactions--either for short-term tracking or for situations where you want to track a range of internal data points.

-

Using your preferred payment method (credit/debit/ACH/check/etc.), we’ll pay suppliers, subcontractors and purchase-on-account vendors for accrued expenses.

-

We’ll do the heavy lifting of invoicing your clients, saving you valuable time while ensuring accuracy.

-

Depending on the nature of your contract, this service will invoice your client at agreed upon completion milestones. We’ll ensure accuracy and report with status updates.

-

Workflow and tracking of earnings against prepayments. Critically important for subscription services like prepaid monthly maintenance contracts, prepaid landcare, etc.

-

If your contract stipulates that clients will "retain", or hold back, a portion of each progress payment until the completion of the project, tracking those amounts is critical from both a project management and business cashflow perspective. We can also apply the same process to your use of subcontractors.

-

We help you use the budgeting feature in QBO to track amounts promised to vendors and sub contractors.

-

We design the work flow for tracking sales commissions through QBO

-

Enables a more complex analysis of your money-in/money-out transactions

-

We’ll use data from the previous year to create a budget projecting future revenue and expenses. Need a projected balance sheet? We can do that too.

Some additional notes:

Co|Constructors is based in Stockbridge, Massachusetts. We are a paper-less bookkeeping service, which allows us to serve clients throughout the state—and beyond. We work exclusively in Quickbooks Online (QBO), which is the most widely used cloud-based accounting software in the USA. It is available anywhere with access to the internet—either through WiFi, LTE or satellite.

During our initial, free, consultation(s), we will discuss your business model, get an understanding of your bookkeeping to date and consider your goals for the short/medium term. Following this, we will develop a proposal that is tailored to you. It will clearly detail our proposed work, estimated cost per month, and whether the first month pricing will be different—and why.

Our goal is to create a plan that is clear, transparent and serves the needs of your business. For clients new to QBO, we happily provide setup of your new account. For businesses requiring a bit of cleanup to their QBO, we can do that too. It’s important to note that the list of services included with each package above are flexible. If, for example, you are considering the Essential plan, but require us to categorize more transactions than are included with that tier, we will price a custom package for you. And, if you’d like to have us take on some of the heavy lifting of creating invoices for your clients, making payments, depreciating fixed assets, or any other task associated with your QBO account, we can do that too. Call 413-597-8928 to get started.